Recent discussions about a proposed $5 million “Gold Card” visa have sparked widespread speculation. Some reports suggest it will replace the EB-5 investor visa, while others frame it as a game-changer for ultra-high-net-worth individuals seeking U.S. residency.

However, during political rhetoric and media noise, key facts are being overlooked. As leaders in investment immigration, our role is not to sensationalize, but to provide a clear, fact-based analysis to help investors make informed decisions.

So, what is happening? Is EB-5 at risk? What should investors do? This article breaks down the facts, legal realities, and investor implications.

Photo by Andrea Piacquadio: https://www.pexels.com/photo/statute-of-liberty-at-daytime-722014/

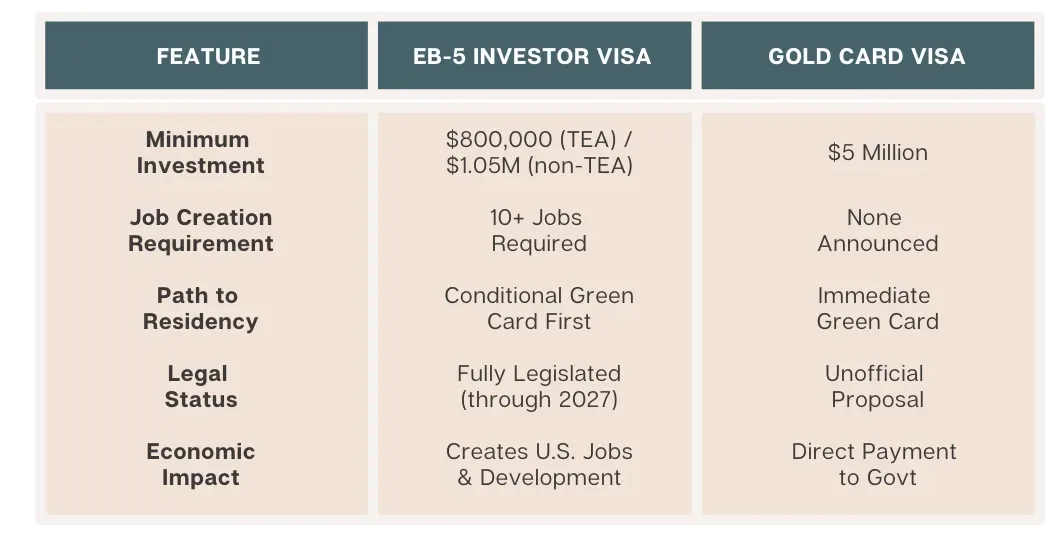

The Gold Card proposal, introduced by President Donald Trump, suggests offering U.S. residency in exchange for a $5 million direct payment to the government. Unlike EB-5— which requires investment in U.S. businesses and job creation—the Gold Card follows a pay- for-residency model.

However, the Gold Card does not yet exist as a visa category. There is:

• No formal bill introduced in Congress

• No regulatory framework or eligibility criteria

• No legislative timeline for approval or implementation

This means the Gold Card is currently a political concept, not a legal reality.

For the Gold Card visa to become law, it must go through multiple legal, political, and

procedural steps. Here’s what the process entails:

• Immigration laws are controlled by Congress, not the President.

• The Gold Card visa must pass both the House of Representatives and the Senate.

• Immigration legislation requires a 60-vote majority in the Senate—meaning bipartisan support is needed.

Key Challenge: Republicans currently hold 53 Senate seats, meaning they would need at least seven Democratic votes—which is unlikely given Democratic opposition to investor visas favoring the ultra-wealthy.

Can the Gold Card be passed through budget reconciliation? No. Unlike tax policy, immigration laws cannot be passed via simple 50-vote budget reconciliation.

Even if approved, agencies like USCIS and DHS would need to:

• Define eligibility criteria, background checks, and fraud prevention measures.

• Establish a formal application and processing system, which could take years.

• Align the program with national security and economic priorities.

A visa based purely on a direct government payment raises legal and ethical concerns. If implemented, it could face:

• National security concerns (ensuring applicants’ funds come from legitimate sources).

• Challenges from immigration advocacy groups, arguing it prioritizes billionaires over skilled workers.

• Lawsuits from EB-5 stakeholders if the program is replaced without a grandfathering provision.

Even if the Gold Card gains political traction, it would take years to implement—if it happens at all. Investors should make decisions based on established immigration programs, not speculative proposals.

Despite speculation, here’s what remains legally and procedurally true:

• EB-5 is fully authorized through September 30, 2027 under the EB-5 Reform and Integrity Act of 2022.

• Investors who file before September 30, 2026, are protected under current law.

• The President cannot unilaterally eliminate EB-5.

• Any attempt to replace EB-5 without congressional approval would face legal challenges and delays.

Key Takeaway: EB-5 remains the only structured and legally protected investor visa in the U.S. Until a fully developed, legislated, and regulated replacement emerges, it is unlikely that EB-5 will be eliminated.

| Claim | Fact-Check |

| “EB-5 will be immediately replaced.” | False. EB-5 remains fully operational and legally protected until at least 2027. |

| “Trump can cancel EB-5 by executive order.” | False. EB-5 is legislated by Congress and cannot be terminated unilaterally. |

| “The Gold Card is a premium Green Card.” | Partially True. The $5M price tag has been mentioned, but no formal details exist. |

| “The Gold Card will have no job creation requirements.” | Unconfirmed. No official framework has been published. |

| “The Gold Card will bring billions into the U.S.” | Unverified. No official financial projections exist. |

What Smart Investors Should Do Now

For those evaluating U.S. immigration options, here’s what matters:

1. If considering EB-5, act while the program is fully operational.

2. Understand that the Gold Card is still a concept.

3. Ignore media hype—focus on legal facts.

4. EB-5 remains the most reliable investment-based immigration option.

The Gold Card is an idea, not a policy. While it has generated attention, it lacks legal foundation, legislative approval, and economic impact considerations. In contrast, EB-5 remains a well-established, structured, and legally protected program. Investors should base decisions on existing policies and clear legislative realities—not speculation. Investment immigration is not about reacting to headlines—it’s about making informed, strategic decisions based on facts.

Posted by: The Financial Express

Authored By: Nicholas Mastroianni III, President and CMO, U.S. Immigration Fund

For more information and to connect with our team of EB-5 Experts, complete a Contact Form.