Section 1: USIF Regional Center

How can an entity become a regional center?

Entities seeking to be designated as a regional center are required to file Form I-956, Application for Regional Center Designation. USCIS will be publishing this new form, including the form instructions, with additional information regarding the filing process by May 14, 2022.

Is USIF a USCIS designated regional center?

Yes, U.S. Immigration Fund was designated as a regional center by USCIS in 2010. As of May 13th, 2022 USCIS has launched a new regional center program that requires Form I-956 for Regional Center Designations. With the EB-5 Reform and Integrity act that repealed the previous Regional Center Program as a result, previously designated Regional Centers must reapply by filing the new Form I-956, Application for Regional Center Designation. USIF previously offered projects through regional centers across the country, and operates regional centers in California, Florida, New Jersey & New York and look forward to doing so again once I-956 approvals happen per project.

What is USIF’s role in the EB-5 Process?

USIF organizes and manages new commercial businesses that foreign investors can invest in, for the purpose of obtaining a U.S. Visa under the EB-5 program. USIF owns regional centers that manage the EB-5 process through foreign agents, immigration attorneys and the U.S. Citizenship & Immigration Services (USCIS). The process includes business plans and reporting as well as preparation of the securities offering documents that meet USCIS requirements.

What resources will USIF provide me with?

USIF’s EB-5 project selection includes “best in class” EB-5 project options that meet 100% of the government’s EB-5 program requirements. USIF also structures the EB-5 project for safety and security for the investor, and provides oversight of the project, developer and the investment. USIF is backed by a strong network of immigration attorneys and developers.

What distinguishes the projects that USIF is/will be affiliated with?

USIF partners with some of the top real-estate developers in the world, and projects typically entail the construction of large-scale commercial and residential buildings. Our team is comprised of a robust network of immigration attorneys as well as experts in commercial lending, construction, finance, legal and marketing fields. With a unique and successful approach, we continue to raise funds and are involved with some of the most recognizable EB-5 projects in the history of the program – from New York to California.

Will USIF assist me in obtaining my Green Card?

Your immigration attorney oversees and prepares the entire application process.

Are previously designated regional centers able to maintain their designation without filing a Form I-956, Application for Regional Center Designation?

No. The EB-5 Reform and Integrity Act of 2022 repealed the legacy Regional Center Program. As a result, previously designated regional centers must reapply by filing the new Form I-956, Application for Regional Center Designation.

Section 2: EB-5 Program

How many Green Cards are allocated each year for foreign investors who invest through the EB-5 Visa Program?

The EB-5 visa program makes approximately 10,000 visas available per year to immigrant investors who invest in commercial enterprises that create at least 10 U.S. jobs.

Is there a visa waiting list for me?

Currently, there is no waiting list for investors for countries other than Mainland China, Vietnam and India.

Is obtaining a Green Card through the EB-5 Regional Center Program suitable for me?

If you and your family meet USCIS requirements and want to immigrate the United States via an EB-5 visa, there are many benefits that are exclusive to the EB-5 program, and not offered via other visa programs.

Should I hire an immigration attorney to represent me?

For such a significant decision, it would be best to hire an experienced immigration attorney when you feel ready to begin your EB-5 investment. The process of gathering your documentation, selecting a project and filing the immigration petition can be a lengthy process that your attorney will oversee.

What are the job creation and investment requirements, and do I need to create them myself for the EB-5 Visa Program? How do jobs qualify for projects that are already under construction?

When investing at the reduced amount of $800,000, the project needs to have I-956 Regional Center approval. When investing in a Regional Center, investors have the advantage of creating indirect jobs, such as construction jobs for a particular EB-5 project. USIF will supply you with an economic report that outlines the estimated job creation per project. Near the end of the two-year conditional green card period, when you choose to remove the conditions from your green card (I-829 application), documents are submitted to show that jobs were created successfully and according to USCIS guidelines.

Am I required to have prior business experience or education to obtain a green card through the EB-5 Visa Program?

No.

Am I required speak English to obtain a Green Card?

No. It is highly recommended that you do look into assistance in translating our documents you receive.

Do I need a sponsor to obtain a Green Card?

No. An EB-5 investor controls their own green card petition process.

Am I required to be in good health?

Yes. You must be able to prove that you do not have any communicable diseases and have evidence from a doctor of having all required vaccinations.

What is the difference between "conditional" and "unconditional" green cards?

An investor approved for an EB-5 visa receives a conditional green card valid for 2 years. In order to remain a permanent resident, a conditional permanent resident must file an I-829 petition (application) to remove the conditions 90 days before the conditional card expires. The conditional card cannot be renewed. An unconditional green card is typically valid for 10 years and can be renewed indefinitely.

Can I apply for an Eb-5 visa if I have been rejected or terminated in the past by USCIS for an L1,E2, B or other visas?

Being rejected in the past does not necessarily disqualify an application unless the reason for rejection was related to immigration fraud.

Are my family members eligible to qualify for an EB-5 Visa? Can my adopted children qualify for an EB-5 Visa?

Spouse

Spouses of the investor are eligible for both conditional and permanent residency once the investor has been granted conditional and permanent residency, respectively. This is applicable when the investor and their spouse were married at the time of the investor’s original admission to the United States as a conditional resident, or at the end of the two-year conditional period when citizenship status will adjust to a lawful permanent resident. It should be noted that a common-law marriage is not recognized for the purpose of permitting a spouse to qualify as a derivative beneficiary.

Children

Children, including step-children and adopted children of the investor, are able to follow the investor who has been granted their conditional permanent residence, or permanent residence. This is valid only if the investor can establish legitimate parent lineage at the time of the investor’s original admission to the United States, or at the end of the two-year conditional period when immigrant status is adjusted to Lawful Permanent Resident.

The U.S. Government considers a ‘child’ as someone who is under the age of 21, and is not married. Any child over the age of 21 at the time the investor files for conditional residency, is considered an adult pursuant to U.S. Immigration law and is not allowed to accompany the principal EB-5 investor as a dependent child. The age and marital status limitations do not apply to the I-829 petition to remove conditions.

My son is about to turn 21 years old in three months, if I invest now will he still be eligible for a green card under my EB-5 visa petition?

It depends on whether a waiting list exists at the time of the conditional residency (I-526) application is approved. If the investor files for conditional residency before the child turns 21, and there is no waiting list for EB-5 visas, then it may be possible for the child to remain with the EB-5 investor’s visa process pursuant to the Child Status Protection Act (CSPA).

CSPA provides some protection to the family immigrating to the U.S. with the general aim of keeping families together. However, there is the possibility that your eligible children could “age-out” during the process, if there is a waiting list for your country.

If a waiting list does NOT exist for your country at the time of the investor’s I-526 approval, the child would be eligible for a green card. However, if a waiting list that exceeds 3 months DOES exist for your country at the time of the investor’s I-526 approval, the child would most likely age-out and be ineligible for a green card.

It is helpful to consider the following examples:

NO WAITING LIST:

- The investor files the I-526 petition and the dependent child is 20 years, 9 months old.

- The I-526 petition is approved 18 months later when the child’s biological age is 22 years and 3 months old. Generally, a child over the age of 21 would not be allowed to receive a green card based on his parent’s I-526 application.

- The CSPA provides some relief in these situations. For the purpose of considering immigration benefits, the child’s age would be calculated in the following way:

- The time the I-526 application was pending with USCIS (18 months from receiving the application to the approval date) would be subtracted from the child’s biological age at the time the I-526 application is approved.

- In the example situation above – at the time of the parent investor’s I-526 is approved- the child’s CSPA age would be 20 years, 9 months old (22 years and 3 months old minus 18-month approval waiting period).

WAITING LIST:

If there is a waiting list for EB-5 visas for a specific country, the above situation is not applicable to the investor’s child. This is a likely scenario if there is a waiting list:

- If a waiting list exists for a specific country at the time of the I-526 approval, then visas would not be immediately available to the specific country.

- The investor and his/her child would not be able to apply for his/her conditional green cards after the I-526 approval date.

- In this situation, the child would continue to age after the I-526 application is approved, and would not be permitted to CSPA relief.

- Once the child’s CSPA age is over 21, the child would be considered to have “aged out” and would be ineligible for a green card based on the investor’s approved I-526 application.

Will my children be able to remain in school in the U.S. If I leave the U.S.?

Dependent children will have their own conditional green card and can work, study and live in the U.S. if the principal investor returns to their home country.

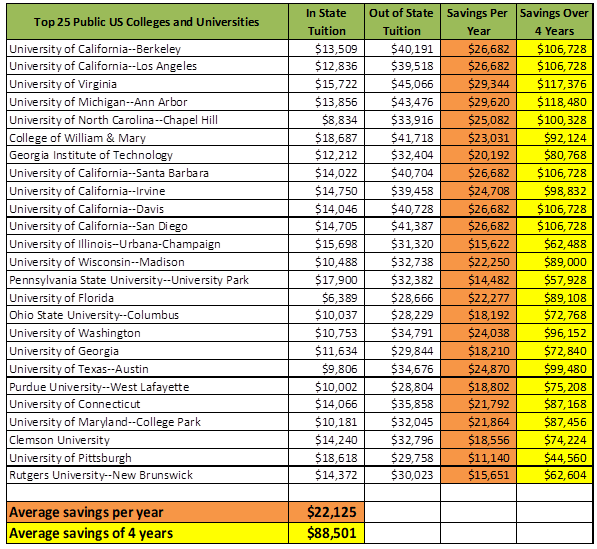

What are the cost benefits of attending a U.S. university and is my child eligible for lower tuition rates?

The EB-5 visa allows a student to gain residency within the state they wish to go to school, and qualify for significant savings on tuition. Public universities in the United States often offer lower tuition to applicants who are residents in the state, where the public university is located. Tuition discounts vary from state to state. See the table below to see the tuition costs per state. The average savings over 4 years is around $88,000 per student.

What changes have been made to the EB-5 Program since The EB-5 Reform and Integrity Act

Now that the EB-5 Regional Center Program has been authorized through 2027, here’s a brief overview of the included updates.

-

The minimum investment amounts has increased to $800,000 from $500,000 for TEA’s

-

The minimum investment amount has increased to 1,050,000 from 1,000,000 in non-designated TEA areas.

-

Investment amounts will be adjusted for inflation every five (5) years starting January 1, 2027

-

TEA’s are defined as single-census-track high unemployment areas which experience an unemployment rate of at least 150% of the national average and combining adjacent high-unemployment tracts and include a rural area with a population less than 20,000 people.

Annual Reserved Visa Categories

-

20% allocated for investments in rural areas (about 20,000 visas)

-

10% allocated for investments in areas designated by the secretary of Homeland Security as high unemployment areas (About 1,000 visas).

-

2% allocated for investment into infrastructure projects (about 200 visas)

-

Unused visas from the reserved categories in any given year will carry over to the following year.

Section 3: EB-5 Process

How long does the EB-5 process take?

Generally, the I-526 adjudication process takes about 15-18 months for the EB-5 investor to receive an approval. A conditional two-year green card is usually received within two years of the initial application. Two months before the expiration of the investor’s conditional green card, the investor must file Form I-829 to remove conditions on his/her permanent residence. This petition takes approximately 24 months to adjudicate. The investor’s conditional green card status is extended indefinitely until the I-829 petition is adjudicated. When the I-829 petition is approved, the investor and his/her dependent children are granted unconditional permanent residence.

While U.S. Citizenship is optional, the investor and their eligible family members may qualify to apply for citizenship within 4 years and 9 months after conditional residency (I-526) is obtained, so long as other naturalization requirements are met.

What kind of background information is USCIS concerned with?

All applicants for non-immigrant visas and green cards will face several security background checks during the immigration process. An investor’s name, date, place of birth and fingerprints will be run against a database maintained by the FBI to make sure there are no “hits”, meaning that no adverse information against the investor is found on various databases such as the Department of Homeland Security, Federal Bureau of Investigation, and various Treasury Department Databases. The U.S. government is concerned with a future immigrant’s involvement with criminal activity, fraud, misrepresentation, health related grounds of inadmissibility, or membership in restricted organizations.

What are the eligibility requirements?

One of the key requirements for immigrating under the EB-5 immigrant investor program is proving that the investor derived the investment funds from a lawful source. The EB-5 investor must prove the lawful source of funds at the I-526 petition stage. The types of documents that have to be provided in order to prove a lawful source of funds are specific to the financial circumstances of each investor.

When do I choose a project and sign documents?

The investor reviews all project offering documents, and consults with advisors on the investment. Once comfortable with the project, the investor signs the offering documents. These documents additionally outline the deposit of the initial investment amount plus any associate fees into escrow bank.

The investor will work with immigration counsel and advisors to prepare these forms, and provide evidence of source of funds. Before accepting investor funds, all investors are screened by USIF and the escrow bank, per U.S. legislation. Once the investor satisfies the escrow bank’s pre-screening requirements, funds are wired into the escrow account related to the project, at the time the offering documents are signed.

When do I prepare the I-526 petition / conditional green card application?

The investor’s lawyer works closely with USIF to prepare the initial green card application (I-526 petition) for the investor and eligible family members. The investors immigration counsel files the I-526 with the USCIS, and the case is assigned a receipt number for tracking.

When do I receive my conditional green card?

Once legal counsel submits the I-526 petition the investor needs to complete the consular process to gain I-526 approval. This can be done in two ways, and depends on where the investor resides at the time of application.

|

Consular Processing (Investor resides outside of the United States)

|

Adjustment of Status Processing (Investor is a valid non-immigrant status in the United States)

|

When do I prepare the I-829 petition / permanent green card application?

Within 90 days of the expiration of the investor’s conditional green card, the investor’s lawyer files the permanent green card application (Form I-829) on behalf of the investor and their family, to remove conditions from their 2-year conditional green cards.

When do I receive my permanent green card?

Once the permanent green card application (form I-829) is approved, conditions are removed and permanent residency is granted. The investor and eligible family members will receive a ten-year permanent green card, which is renewable indefinitely.

When can I obtain U.S. Citizenship?

While U.S. Citizenship is optional, the investor and eligible family members may qualify to apply for citizenship within 4 years and 9 months after conditional residency (I-526) is obtainer, so long as all other naturalization requirements are met.

Source of funds report: Can my EB-5 investment funds originate from a salary earned in the United States?

Yes.

WHEN CAN I FILE A REGIONAL CENTER RELATED I-526?

Individuals seeking status as an immigrant investor whose investment project is associated with a regional center (with an approved Form I-956 after May 14, 2022), may file a Form I-526, Immigrant Petition by Alien Entrepreneur.

Only after the regional center has submitted a project application and received a receipt number for that application. USCIS has resumed processing regional center-related Form I-526, Immigrant Petition by Alien Entrepreneur, filed on or before June 30, 2021, the sunset of the previous regional center program.

USCIS will adjudicate those Forms I-526 petitions according to the applicable eligibility requirements at the time such petitions were filed (that is, the eligibility requirements in place prior to the enactment of the new legislation on March 15, 2022).

Section 4: Your Investment

Does the entire $800,000 investment have to be made at the time of applying for an EB-5 visa?

Yes. Per USCIS, the investment and fees must be deposited in full prior to filing the I-526 application with USCIS.

How can I submit my investment funds?

The escrow agreement which includes wire instruction for the escrow account, is provided to you with offering documents. Your agent will confirm receipt of your investment funds. This receipt is required to be included as part of your I-526 application.

What is meant by the requirement that the investors assets must be “lawfully gained”?

Under USCIS guidelines, the investor must prove their investment funds were gained in a lawful manner. The investor is required to prove their investment funds were obtained through a lawful business, salary, investment, property sales, inheritance, gift, loan or other lawful means.

Can money gifted by a parent or other relative be used for an EB-5 investment?

Yes, as long as applicable gift taxes are applied and paid. Gifts must be able to be traced to the lawful origin.

Would my global income and assets be taxable in both my country of origin and in the United States?

Generally, under U.S. tax laws, applicants who become U.S. green card holders (permanent residents), and spend 180 days in the U.S., are likely considered residents of the United States for tax purposes. The general rule is that a person who is a U.S. tax resident, is taxed on their worldwide income. Assets are not typically taxed unless income is generated on the asset or the asset is sold and taxable financial gain results.

How would the U.S.-India Double Taxation Treaty be used to minimize the investors tax liability?

The U.S. and India have entered into a Double Taxation Avoidance Agreement, which seeks to minimize situations where people and companies are taxed both in the U.S. and India. Our law firm strongly recommends potential EB-5 investors to seek professional tax advice to address their individual tax situation and enable proper tax planning. Our law firm does not advise on U.S. taxation issues

When will my initial investment be returned to me?

Investment funds are typically returned to the investor once the Job Creating Entity (JCE) concludes the project successfully and EB-5 requirements have been met. Repayment usually takes 4-5 years of the investor’s conditional Green Card application (I-526).

Section 5: Green Card

What documents and information are required for my I-526 Petition?

Your attorney will review the documents required for your I-526 petition. As part of the documentation and evidence gathering, the investor will need to provide detailed documentation showing how his investment capital was acquired. USCIS requires proof of lawful source of funds and independent evidence support all investment funds provided. Examples of evidence include bank statements, stock certificates, loan mortgage documents, promissory notes, security agreements, etc.

Once I receive my conditional green card when do I apply for my permanent green card?

You must file an I-829 Petition (application) to remove the conditions on your permanent resident status. This must be filed within 90 days before your conditional green card expires. After you file your I-829 Petition, your conditional resident status will be extended until the processing of your I-829 Petition has been completed.

Can my permanent green card be taken away? How do I keep my permanent green card after I receive it?

There are two requirements to keep residency for life: 1) You cannot be convicted of a serious crime, and, 2) you cannot abandon the U.S. as your permanent residence.

How much time must I spend in the U.S. each year?

Generally, once you become a conditional permanent resident, you should spend at least 180 days each year in the United States. There are several exceptions to the 180-day rule including studying abroad, medical circumstances, or emergency business circumstances. In these cases, a re-entry permit may be granted.

What is the difference between permanent residency and citizenship?

Once you are granted U.S. conditional residency you are entitled to most of the rights U.S. Citizens, except you may not vote and you are not entitled to some public benefits. You do have the same tax requirements and rates as U.S. citizens. You are allowed to travel outside of the U.S., however you should review the rules and regulations with your attorney regarding lengthy periods away. Generally, the USCIS views any period away from the U.S. longer than 180 days as “abandonment”, and not temporary.

As a U.S. resident, you have the right to apply for U.S. Citizenship after approximately 5 years, given there are no waiting lists for your country. In order to qualify to apply to become a U.S. citizen through naturalization you must become a Legal Permanent Resident (LPR) and remain a LPR for 5 years. You must also be physically present in the United States for 30 months during the 5-year period prior to the naturalization application. Once the naturalization process is complete, the individual has the right to vote and hold public office.

Am I entitled to keep my citizenship from my country of origin?

This varies by country. The U.S. allows dual citizenship, however your country of origin may not. This is a great topic to discuss with your immigration attorney.

Section 6: New EB-5 Regulations Effective November 21, 2019

When do the new EB-5 rules become effective?

November 21, 2019. All new I-526 visa petitions filed on or after November 21, 2019, must satisfy the new requirements set out in the Final Rule.

Will the minimum investment amount go up on November 21, 2019?

Yes. The minimum investment amounts will increase to US$800,000 for investments in rural areas or high unemployment areas (known as a Targeted Employment Area or “TEA”). For all other areas, the investment threshold will go up to US$1.05 million.

Are the new EB-5 Regulations retroactive?

No. The Final Rule expressly provides that they do not have retroactive effect. The new EB-5 Regulations only apply to new I-526 visa petitions filed on or after November 21, 2019.

When will new EB-5 investments become available at the $800,000 threshold?

The minimum investment amounts are now increased to $800,000 from $500,000 for TEA’s and 1,050,000 in non-designated TEA areas.

The implementation of the I-956 will have an impact on new regional center investor I-526 petitions and they may only file an I-526 petition only after the regional center has I-956 approval, submitted a project application and received a receipt number for that application. This new rule does not impact investors who have filed I-526 prior to March 15, 2022 with a regional center even while the regional center goes through the process of re-designation.

We encourage you to do research, get in touch with us to learn more. For legal resources please Donoso and Partners, who we work with closely.

USCIS has resumed processing regional center-related I-526 Immigrant Petitions filed on or before June 30, 2021. USCIS will adjudicate those Forms I-526 petitions according to the applicable eligibility requirements at the time such petitions were filed (that is, the eligibility requirements in place prior to the enactment of the new legislation on March 15, 2022). The need to reapply as a regional center does not impact petitions pending prior to March 15, 2022 associated with those entities.

If I have a pending I-526 EB-5 visa petition, will I have to invest more capital to keep my visa process?

No. The new EB-5 Regulations do not require EB-5 investors that have already properly filed an I-526 visa petition to invest more capital to maintain their EB-5 visa process after November 21, 2019. The exception to this statement are the priority date retention rules for second EB-5 visa petitions (see below).

Will the new EB-5 Regulations allow for priority date retention?

Yes. The Final Rule allows EB-5 investors whose I-526 visa petition was approved (“Original EB-5 Petition”) to retain the priority date when submitting a second and subsequent EB-5 petition (“Second EB-5 Petition”). The rule only applies to approved I-526 petitions – even if the petition was eventually revoked due to a project related issue, regional center related issue or investor issue (so long as it is not fraud or misrepresentation or material error by USCIS). Priority date retention is not available if the investor eventually obtained Conditional Lawful Permanent Resident status based on the Original EB-5 Petition.

I invested in a New Commercial Enterprise that had a pending I-924 Exemplar. Will USCIS adjudicate that application differently after November 21, 2019?

No. If you invested in a New Commercial Enterprise (NCE) before November 21, 2019 and properly filed your I-526 visa petition, and the NCE is waiting to receive a decision on an I-924 Exemplar Application from USCIS, the new EB-5 Regulations should not change the rules that USCIS will apply when making a decision on the pending I-924 Exemplar Application. Similarly, your I-526 visa petition properly filed before November 21, 2019 will be adjudicated by USCIS based on the current rules in force before November 21, 2019.

Will USCIS allow “place-holder” I-526 visa petitions filed before November 21, 2019?

No. Current USCIS rules and policies require all I-526 visa petitions to be filed with sufficient evidence for USCIS make a decision on the application. Petitions that are mere placeholders with little or no evidence will likely be denied by USCIS in its efforts to prevent investors from trying to reserve an investment at the current $500,000 investment threshold for TEA areas.

If my current I-526 visa petition is approved, will the new EB-5 Regulations affect me?

No, not likely. The new EB-5 Regulations do not change the rules for I-526 visa petitions that are properly filed before November 21, 2019 and that eventually are approved by USCIS.

Do the new EB-5 Regulations change the number of visas available for the EB-5 program?

No. The Final Rule does not change the rules regarding the number of EB-5 visas or the rules regarding waiting lists. Nevertheless, the increase in the investment thresholds to $800,000 for TEAs and $1.05 million for other areas are likely to have a two-fold effect on EB-5 visa usage.

EB-5 Visa set-asides have been updated with 32% priority within a fiscal year for specific projects with the following updated breakdown:

-

- 20% will be set-aside for rural projects.

- 10% will be set-aside for high unemployment areas.

- 2% will be set-aside for infrastructure projects.

How does Grandfathering work as of the EB-5 Reform and Integrity act?

Cases filed prior to the Reform and Integrity Act (RIA) will be adjudicating under the law at the time of filing and are not subject to the new law. No increased investment or new TEA rules apply to pending grandfathered cases. If the regional center program sunsets in the future, investors will not face a pause in processing.b Cases filed before the new sunset date of September 30, 2026 will be grandfathered to completion regardless of program expiration.